09 March 2017

Making Sense of Financial Aid Packages

With admissions decisions around the corner, many of you will need to consider affordability and make sense of the financial aid packages coming your way.

In this article, we'll define some key terms, work through a case study to make the process more tangible, and provide some key takeaways for you to apply to your own situation.

Click on continue reading for more.

With admissions decisions coming soon, one of the topics Mom and Dad are going have to consider is affordability. This article focuses on how to make sense of the financial packages that come your way. First, we'll define some key terms, then we'll work through a case study and finally wrap up with key takeaways.

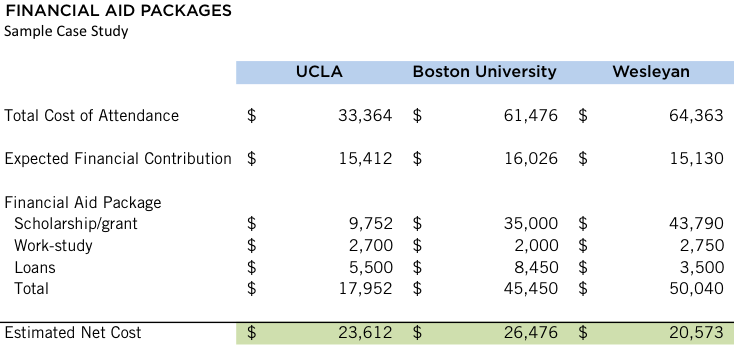

Note, the financial aid packages presented herein are purely hypothetical. Though we've used the net price calculator for each institution to come up with representative amounts, understand they are simply estimates.

Definitions

- Total cost of attendance. The total expected cost to attend the admitting institution. This includes tuition, room and board, books and supplies, transportation and living expenses.

- Expected financial contribution (EFC). This is the amount that you and your parents are expected to contribute towards the cost of your education. This value is determined by the FAFSA paperwork you filed as part of the application.

- Financial aid package. A financial aid package summarizes what the admitting institution is offering to you to cover the cost of attendance. Some schools are able to offer packages that cover the entire difference between the cost of attendance and your EFC, but most do not. A financial aid package usually consists of three types of aid—scholarships, work-study and loans.

- Scholarship/grant aid. Scholarships and grants are outright awards which do not need to be repaid. They are driven by need and sometimes merit, depending on the institution. The bigger this number, the better!

- Loans. Loans are just that—funds that are lent to the student or parent and must be repaid in the future. The terms of a loan vary depending on the source. This is the least attractive component of a financial aid package.

- Work-study. This is the amount that you will be expected to earn through campus jobs that will be made available to you during the school year. Work-study isn’t as good as a scholarship or grant since you have to allocate 8-12 hours per week to work, but it’s better than a straight-out loan that you'll have to repay with interest.

- Net cost. Net cost is the total cost of attendance less the amount of scholarship/grant money you receive. This is a very important number because it is a truer indication of what the cost of your education will be.

Sample Case Study

Let me introduce you to Mary, a senior at ABC High School in California. Mary is a very good student and has received acceptance letters from UCLA, Boston University, Wesleyan University and Princeton University, and now she and her folks have to figure out whether or not they're affordable.

Mary's folks both work and earned $110,000 in income last year, and have a total of $50,000 in savings to their names. In addition to Mary, they have a younger son, Bruce, who is a sophomore at the public high school Mary attends. Mary has no income or savings to her name.

1. UCLA

The first financial aid package they review is from UCLA.

- Total cost of attendance. As a California resident, Mary benefits from in-state tuition. All told, the total cost of attendance is $33,364. Mary and her folks all expect UCLA to be the most affordable of the four schools she was admitted to.

- Expected financial contribution (EFC). Based on the FAFSA filing, UCLA expects Mary's family to contribute $15,412 towards this cost from current income or savings.

- Financial aid package. UCLA's financial aid package covers the difference, $17,952. Of this amount, $9,752 is in the form of scholarship aid, which doesn't need to be repaid, another $2,700 in work-study, and the remaining $5,500 in the form of loans.

- The net cost is $23,612. Factoring in the scholarship Mary was awarded, the net cost to attend UCLA is $23,612.

2. Boston University

Using the UCLA package as a baseline, Mary and her folks look next at Boston University.

- Total cost of attendance. No surprise here, BU is nearly twice the cost of UCLA.

- Expected financial contribution (EFC). Surprise here: although the cost of attendance is considerably higher at BU, the EFC is roughly the same as it is at UCLA. That's a good sign because it means that BU is offering a more generous financial aid package.

- Financial aid package. BU's total financial aid package is $45,450 vs. $17,952 at UCLA. More importantly, BU is offering considerably more scholarship aid, less work-study and more loans. Mary and her parents learn three things:

-

- It's not that much more expensive to attend BU. After factoring in scholarship aid, the net cost to attend BU is only about $3K more than UCLA, not the $28K difference suggested by cost of attendance. This makes BU a more viable opportunity than they originally imagined.

-

- Mary won't have to spend as much time working during the school year. The work study component of the aid package at BU is about 25% less than UCLA's. That's potentially 2-3 less hours of work each week, leaving more time for getting an education. Another plus for BU.

-

- Mary's family will need to take out an additional $3K in loans to cover the diference. BU is still more expensive, and to cover the cost after scholarship and work-study, Mary's family will need to take out a loan for $8,450 on top of the $16,026 they're expected to contribute. UCLA wins here.

- So far, UCLA is still cheaper but not by nearly as much as Mary and her folks had expected.

3. Wesleyan University

With UCLA and BU under their belts, Mary and her parents turn their attention to Wesleyan.

- Total cost of attendance. Like Boston University, Wesleyan is nearly twice the cost of UCLA.

- Expected financial contribution (EFC). The expected financial contribution for Wesleyan is roughtly the same as those of UCLA and BU.

- Financial aid package. Wesleyan's financial aid package is $50,040 vs. $17,952 at UCLA and $45,450 at BU. In looking at the mix of aid, Mary's family gleans three insights:

-

- It's actually cheaper to attend Wesleyan than it is to attend UCLA. Wesleyan’s generous grant aid takes its net cost down to $20,573 vs. $23,612 at UCLA. This is a real surprise to Mary's family and a plus for Wesleyan.

-

- There's a bit more work-study obligation at Wesleyan versus BU. The work-study component is comparable to UCLA and a bit higher than BU. Advantage BU.

-

- Mary's family won't have to take out as much in loans. To cover the cost after scholarship and work-study, Mary’s family is expected to contribute $15,130 and take out $3,500 in loans. Relative to UCLA and BU, this is another plus for Wesleyan.

- At this juncture, Wesleyan appears to have the most attractive financial aid package in terms of net cost and mix of loans.

4. Princeton University

Last but not least, Mary and her folks review the Princeton financial package.

- Total cost of attendance. Princeton's total cost of attendance is comparable to BU and Wesleyan.

- Expected financial contribution (EFC). Thanks to a very strong endowment and a commitment to meeting 100% of demonstrated need, Princeton’s EFC is considerably smaller than the rest of the schools. This is a very good sign in terms of affordability.

- Financial aid package. Mary’s total financial aid package from Princeton is $51,860. This is comparable to Wesleyan’s in terms of size, but Mary's family notes major differences in the mix of aid offered and discover that:

-

- It's considerably cheaper to attend Princeton. Princeton’s generous scholarship aid makes the net cost of attending Princeton at least 35% cheaper than any of the other schools, including UCLA. This is a huge plus for Princeton.

-

- Mary will have a higher work-study obligation. The work-study component is the highest at Princeton, which means less time for getting an education. Assuming $10 per hour and 12 weeks per semester, this translates to about 12 hours of work-study per week.

-

- No loans are in the mix. To cover the cost after scholarship and work-study, Mary’s family is expected to contribute $10,400 from current income and savings, that’s it. No loans! This is massive plus for Princeton.

- On balance, Princeton offers a superior financial aid package. It is the cheapest to attend, and the mix is rich in scholarship aid and void of loans. Assuming this is Mary's top choice, there should be no financial barrier preventing her attendance there.

Key Takeaways

Hopefully this case study has helped you to make better sense out of financial aid packages and given you a way to evaluate them against each other. We think there are three takeaways to apply as you evaluate your financial aid options in the upcoming weeks:

- Focus on expected financial contribution. Each institution determines your expected financial contribution differently. Some of this is based on how they account for your financial situation, and some of this is based on the extent to which they are able to cover full demonstrated need. As we've seen with Princeton's package, the EFC can vary widely, to the tune of 30-35% in Mary's case.

- Focus on net cost, not the cost of attendance. Affordability rarely has to do with the cost of tuition. As we’ve seen here, private schools costing nearly twice as much as UCLA are in fact cheaper to attend after you factor in scholarship/grant aid.

- Focus on the package mix, not the dollar amount. As we’ve also seen in this case study, it’s not enough to look at the dollar amount of an aid package to draw a conclusion on which is best. You need to understand how the package breaks down into scholarship aid, work-study and loans to make the right call. Wesleyan and Princeton both offer $50K aid packages, but Princeton’s comes with far more scholarship aid and better yet, no loans. Always look for packages with lots of scholarship and little to no loans.

Good luck!

- Tags: Financial Aid

Get our latest data and insights

Give your college plan a boost

Balance list, maximize odds and minimize wasted motion. Current data and personalized recommendations.

Students, learn more Counselors, learn more

Archives

- Your College List (105)

- Early Admission (251)

- Standardized Testing (15)

- Class of 2029 (49)

- Class of 2028 (54)

- Class of 2027 (64)

- Class of 2026 (62)

- Class of 2025 (78)

- Class of 2024 (69)

- Class of 2023 (87)

- Class of 2022 (82)

- Class of 2021 (80)

- Class of 2020 (65)

- Class of 2019 (6)

- Waitlist (10)

- Financial Aid (4)

- College Tour Planner (0)

- Whirlwind Tours (0)

- Essays (9)

- College Kickstart (58)

- Product Announcements (12)

- Perspectives (102)

- College Rankings (28)

- Affordability (12)

- AP Exams (3)

- Miscellaneous (11)

Hot Topics

- Princeton

- Swarthmore

- Wesleyan

- Class of 2021

- Class of 2023

- Duke

- University of Virginia

- UC Berkeley

- Notre Dame

- Early Decision

- Boston University

- UC Santa Barbara

- Rice

- UC Davis

- Northwestern

- Boston College

- Cornell

- Vanderbilt

- Johns Hopkins

- Dartmouth

- Early Action

- UCLA

- Middlebury

- Emory

- MIT

- Class of 2022

- Stanford

- Ivy League

- UC Irvine

- Colby

- Yale

- Georgia Tech

- Columbia

- Williams

- Pomona

- Claremont McKenna

- Harvard

- Georgetown

- Brown

- University of Pennsylvania